As we step into 2024, the landscape of finance and investment continues to evolve at a remarkable pace. Embracing innovation is no longer just an option; it’s a necessity for anyone looking to navigate this challenging yet exciting frontier. With new technologies and trends emerging, investors must adopt fresh strategies to seize opportunities while mitigating risks. Understanding these dynamics can empower you to make informed decisions in a shifting financial ecosystem.

Main Points

- Identifying emerging investment trends for the upcoming year.

- Leveraging technology to enhance investment decisions.

- Diversifying portfolios to manage risk effectively.

Related content:

Life: The Unexpected Lessons Found in Everyday Moments

Emerging Trends in 2024: Identifying Lucrative Investment Opportunities

As we step into 2024, a whirlwind of economic shifts unveils a realm of finance possibilities. Investors must navigate this landscape carefully. The interplay between technology and sustainability is especially intriguing. How can one capitalize on this? Here are a few key areas to watch:

- Sustainable Investments: Focus on green technology, as demand is skyrocketing.

- Digital Currencies: Cryptocurrencies continue to evolve, making them worthy of attention.

- Health-Tech Innovations: The intersection of healthcare and technology is a game-changer.

These sectors not only promise growth but also offer ethical alignment. Therefore, it’s crucial to stay informed and adaptable in this dynamic environment.

Sustainable Investing: Balancing Profitability with Environmental Responsibility

In our rapidly changing world, sustainable investing emerges as a harmonious dance between profit and purpose. Investors face a crucial question: can we achieve economic growth while respecting our planet? This delicate balance often leads to moments of confusion, as some argue that financial gains may overshadow environmental duties. However, embracing sustainability can yield enriching rewards. By aligning finance strategies with eco-friendly goals, investors foster not only personal wealth but also the health of our planet.

Why It Matters

Adopting sustainable practices isn’t merely a trend; it’s a transformative movement that shapes finance sectors worldwide. Investors now demand transparency, holding companies accountable for their environmental impact. Yet, the journey remains fraught with complexities and dilemmas, prompting discussions on where to draw the line. Ultimately, blending profitability with stewardship of our Earth leads to enlightened investing.

| Aspect | Impact |

|---|---|

| Financial Returns | Potential growth opportunities |

| Environmental Benefits | Reduced carbon footprint |

| Community Well-being | Stronger, healthier societies |

Ultimately, sustainable investing challenges us to rethink traditional notions of finance. By choosing a path that respects and revitalizes our environment, we pave the way for a brighter, balanced future.

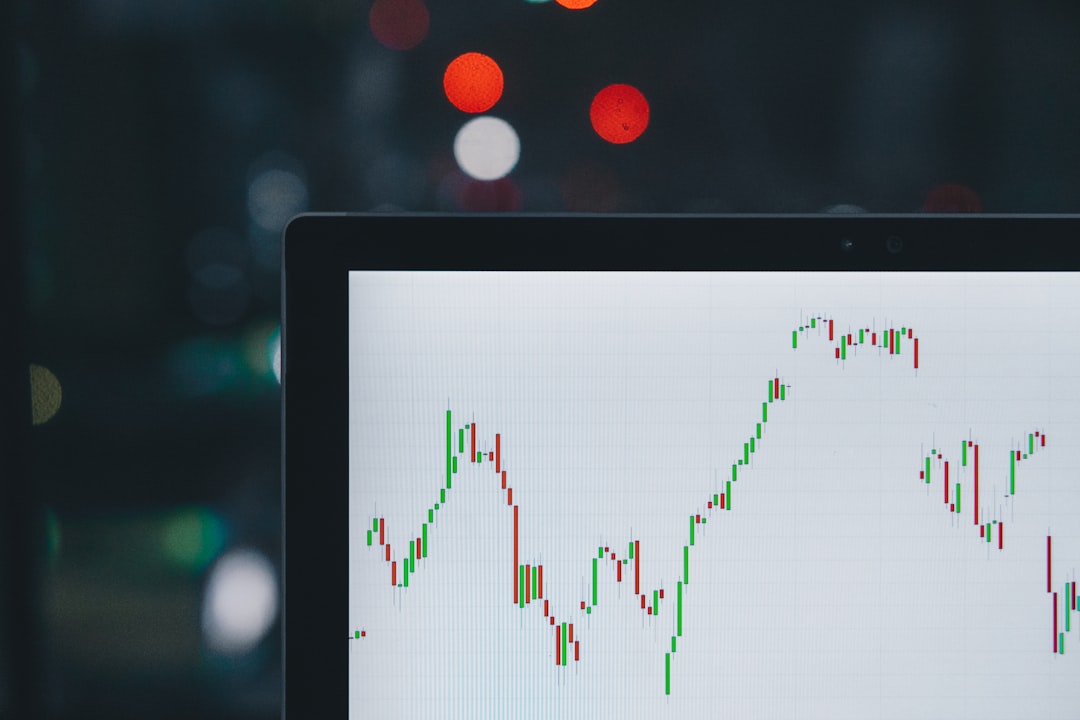

The Impact of Technology on Investment: Leveraging AI and Blockchain in Your Portfolio

In today’s rapidly evolving landscape, technology reshapes how we approach finance. Artificial Intelligence (AI) creates unparalleled opportunities for investing, analyzing vast data sets to inform decisions. Meanwhile, blockchain revolutionizes asset management, ensuring transparency and security. However, embracing these advancements can be daunting. Investors often grapple with the sheer volume of information and complex jargon, which can lead to uncertainty. Yet, tackling this confusion is essential to fully harnessing the power of technology in your finance journey. So, are you ready to dive in?

Diversification Strategies: Minimizing Risks in an Unpredictable Market

Diversification stands as a formidable shield against the chaotic waves of the finance world. By allocating resources across varied assets, savvy investors can cushion their portfolios from unexpected shocks. Yet, not all paths lead to safety. It’s crucial to balance risk and reward, creating a tapestry of investments that feels right for you. Consider these strategies:

- Asset Mix: Diversify between stocks, bonds, and alternatives.

- Geographical Spread: Invest in international markets to broaden horizons.

- Sector Exposure: Balance investments across different industries.

Your choices in finance should mirror your risk tolerance. Risks linger everywhere, but a well-crafted diversification strategy can help you sail more smoothly. Aim for an adaptable portfolio that resonates with your personal journey in the finance landscape, embracing growth while fortifying against uncertainties.

Navigating Economic Uncertainty: Adapting Investment Strategies for Market Volatility

In times of economic uncertainty, investors often find themselves in a tangled web of decisions. Adapting your investment strategies requires more than just a keen eye on the market. Indeed, understanding the nuances of behavior in finance can provide a surprising edge. One must assess risk tolerance and diversify wisely, knowing that volatility brings both challenges and opportunities. Surprisingly, it’s the unexpected trends that can lead to rewarding outcomes. Staying informed is essential; yet, keep in mind, patience is key.

Embracing Change

As the landscape shifts, embrace innovation in your finance approach. Explore alternative investments that might align with your aspirations. Ultimately, navigating through ups and downs requires not just strategy, but also resilience. The journey may feel chaotic, but with the right mindset, it can lead to enriching experiences and enhanced finance wisdom.

You Can Also Review These:

NAVIGATING INVESTMENT STRATEGIES FOR 2024 – LinkedIn

Conclusion

In conclusion, understanding the nuances of finance and investment is vital for anyone looking to navigate today’s complex economic landscape. Knowledge in this area empowers individuals to make informed decisions about their financial futures. While the journey may seem daunting, the rewards of careful planning and strategic investments are undeniable. Moreover, maintaining a curious mindset allows for the continual growth of your financial acumen. Therefore, embracing the challenges and opportunities within finance and investment will ultimately lead you to greater stability and success in your monetary endeavors.

Frequently Asked Questions

What is the difference between finance and investment?

Finance refers to the management of large amounts of money, especially by governments or large companies. Investment, on the other hand, is the act of allocating resources, usually money, in order to generate income or profit.

What are the different types of investment options available?

Common types of investment options include stocks, bonds, mutual funds, real estate, and exchange-traded funds (ETFs). Each has its own risk and return profile.

How can I start investing with a small amount of money?

You can start by setting up a brokerage account that allows for fractional shares, investing in low-cost index funds or ETFs, or using investment apps that cater to beginners and allow for small investments.

What is the importance of diversification in investment?

Diversification is important because it helps to spread risk across different asset classes. By investing in a variety of assets, you can reduce the impact of any one investment’s poor performance on your overall portfolio.

How do interest rates affect investments?

Interest rates can have a significant impact on investments. Generally, when interest rates rise, bond prices fall and stock prices may also be affected as borrowing costs increase. Conversely, lower interest rates can make borrowing cheaper and boost investment in stocks.