As we dive into the tumultuous waters of this week’s economic landscape, the latest updates in the world of finance have stirred up both confusion and opportunity for investors. Navigating through this storm requires a keen eye and an open mind. With fluctuations in the market and shifting trends influencing our financial decisions, staying informed about the finance news is more crucial than ever. Understanding how these developments affect your investments can empower you to make more strategic choices. So, grab your umbrella and let’s explore what this week’s financial updates mean for your financial future.

Main Points

- Recent market fluctuations highlight the importance of timely investment strategies.

- Key indicators in the finance news provide insights into potential opportunities.

- Investor sentiment is shifting, signaling a need for adaptability in financial planning.

Related content:

Navigating the Tech Jungle: Innovations Shaping Tomorrow’s World

Understanding Market Volatility: Key Insights from This Week’s Financial Developments

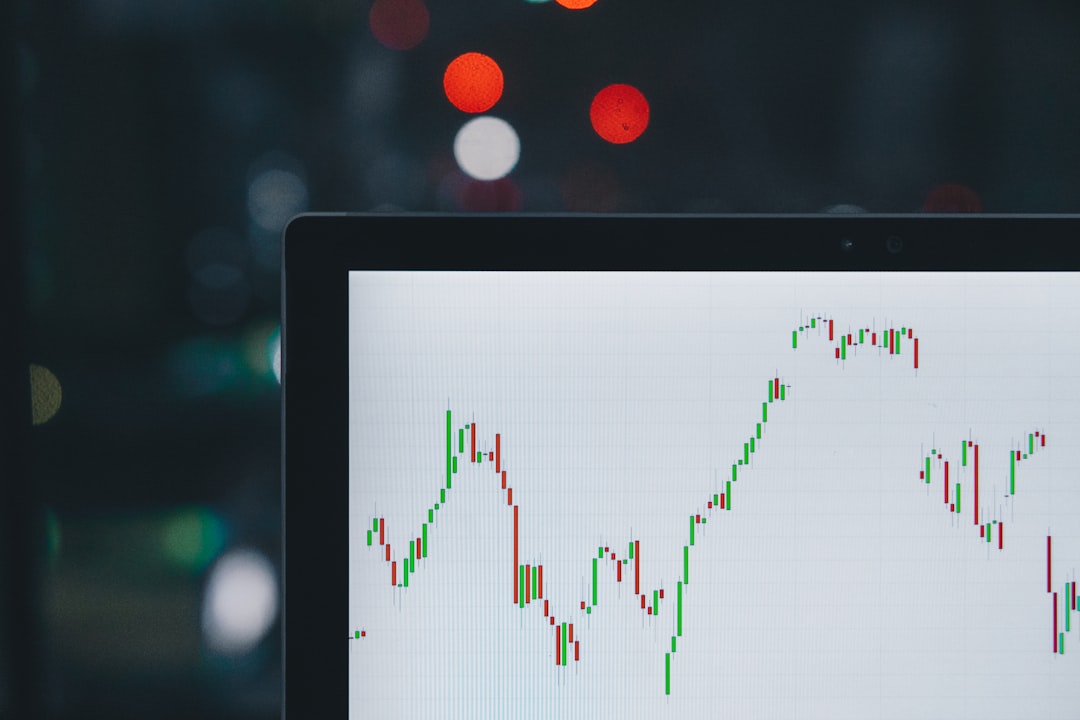

This week, the winds of finance shifted dramatically, leaving investors grappling with uncertainty. As headlines flashed about fluctuating stock indices, many might wonder: what exactly drives this volatility? Understanding the undercurrents requires a closer inspection of both macroeconomic indicators and investor sentiment. The situation feels like a pendulum swinging wildly, with global events influencing local markets in unexpected ways. However, amidst this chaos, discerning patterns can unveil hidden opportunities for the astute observer.

Key Factors Influencing Market Volatility

- Interest Rates: Changes in central bank policies can cause ripples across the finance landscape, affecting borrowing costs and investment decisions.

- Geopolitical Events: Tensions and developments around the world can create sudden shifts, prompting volatility in stock prices.

- Economic Data Releases: Reports on employment, inflation, and growth can shift market perceptions overnight, leading to rapid changes in momentum.

Understanding these factors not only helps navigate the storm but can also illuminate pathways to resilience in finance.

Top Economic Indicators to Watch: How Recent Trends Impact Your Portfolio

As we navigate the ever-shifting landscape of finance, staying attuned to key economic indicators becomes crucial. Inflation rates and interest trends can shape your investment strategies profoundly. Additionally, consider employment statistics which often reflect the economic pulse. These elements together can illuminate potential growth or impending downturns. However, the interplay of these indicators might sometimes appear chaotic. Thus, maintaining a keen eye on them allows for informed decisions, ultimately influencing your finance portfolio’s resilience.

Key Indicators to Monitor

| Indicator | Importance |

|---|---|

| Inflation Rate | Impacts purchasing power |

| Interest Rates | Affects borrowing costs |

| Employment Data | Indicates economic health |

Sector Performances Under Pressure: Which Industries Are Leading and Lagging?

In today’s turbulent economic climate, the finance sector finds itself in a precarious position. While technology companies are thriving, the retail industry struggles to keep pace. Investors are keenly watching these shifts, as the finance industry grapples with rising interest rates and global uncertainties. Meanwhile, healthcare has emerged as a resilient performer, proving its mettle amidst the chaos. Observers may wonder, can the finance sector rebound? Or will it continue to lag behind more dynamic industries?

Expert Predictions: What Analysts Are Saying About Future Investment Opportunities

As the financial landscape evolves, analysts offer captivating predictions on where to invest next. A blend of cautious optimism and innovative strategies shapes their insights. They hint at sectors poised for growth, but some caution against the noise of rapid trends. Here’s a closer look:

- Tech Innovations: Analysts believe technology will drive investments, especially AI and renewable energy.

- Emerging Markets: Many suggest these markets could provide unexpected returns, yet they harbor risks.

- Healthcare Evolution: With an aging population, healthcare investments are becoming increasingly vital.

In this complex tapestry of potential opportunities, it’s essential to navigate wisely, weighing risks and benefits before diving in.

Strategies for Resilience: How to Safeguard Your Investments Amid Market Uncertainty

In the ever-shifting landscape of finance, it’s vital to cultivate resilience. Begin by diversifying your portfolio to mitigate risks. Consider allocating resources across various sectors, enabling you to weather economic storms effectively. Furthermore, regular assessments of your investments help you stay proactive. Be mindful of emotional decision-making; it often clouds judgment. Keep in mind, a well-structured strategy can turn uncertainty into opportunity. Ultimately, resilience is about adapting and thriving, even when the market feels erratic.

You Can Also Review These:

Navigating the Storm: Investing in Uncertain Times

Conclusion

In the ever-evolving landscape of finance news, staying informed is crucial. Many individuals find themselves overwhelmed by the constant flow of information. However, being well-versed in current financial developments can significantly impact personal and professional decisions. Therefore, keeping an eye on reliable sources is essential. Engaging with finance news not only enhances our understanding of market dynamics but also empowers us to make more informed choices. In this fast-paced world, let’s prioritize staying informed and connected to the financial narratives that shape our lives.

Frequently Asked Questions

What are the main indicators of a healthy financial market?

The main indicators include stock market performance, interest rates, inflation rates, and employment figures.

How can I start investing in the stock market?

You can start by researching companies, opening a brokerage account, and considering starting with index funds or ETFs to diversify your investment.

What is the difference between stocks and bonds?

Stocks represent ownership in a company, whereas bonds are loans made to a company or government that pay interest over time.

What are some common strategies for personal financial management?

Common strategies include creating a budget, saving a portion of your income, investing in retirement accounts, and minimizing debt.

How does inflation affect my investments?

Inflation erodes purchasing power, meaning the returns on your investments must outpace inflation to grow your wealth effectively.