In a world where financial literacy is often overlooked, the significance of understanding money management has never been more critical. Many individuals navigate life without a solid grasp of financial principles, leading to stress and uncertainty. Therefore, finance education emerges as a beacon of hope, illuminating paths toward financial independence and empowerment. By unlocking the doors to sound financial practices, we can transform our relationship with money and build a secure future. Embracing this knowledge not only enhances our personal lives but also strengthens communities, ultimately fostering a brighter economic landscape for all.

Main Points

- The importance of financial literacy in everyday life.

- How finance education empowers individuals to make informed decisions.

- The impact of financial knowledge on personal and community well-being.

Related content:

Unlocking Wealth: Innovative Strategies to Master Your Money Management

The Importance of Finance Education in Today’s Economic Landscape

In an era where financial literacy is paramount, especially amid fluctuating markets, understanding finance transforms from a mere skill into a crucial lifeline. Financial education empowers individuals, providing them with the tools to navigate complex economic terrains. However, it’s not always straightforward. Here are a few reasons why finance education holds tremendous significance:

- Empowerment: Educated individuals make informed decisions, influencing both personal and societal financial outcomes.

- Resilience: A solid grasp of finance can shield against economic downturns, fostering stability.

- Opportunity: Knowledge opens doors, allowing individuals to harness investments and retirement planning effectively.

Thus, financial education is not merely a benefit; it is an essential facet for survival and success in today’s economic landscape.

How Financial Literacy Empowers Individuals and Communities

Understanding finance is not merely a skill; it’s a potent superpower. When individuals grasp financial concepts, they can navigate life’s complexities with confidence. This knowledge allows them to make informed decisions, set achievable goals, and create sustainable plans. Communities thrive when members possess financial literacy, leading to reduced poverty and increased economic participation. Without it, myths and misunderstandings can proliferate. Ultimately, knowledge connects, empowers, and transforms aspirations into reality, fueling a brighter future for all.

Key Benefits of Financial Education

| Benefit | Description |

|---|---|

| Debt Management | Understanding repayment strategies protects individuals from financial strain. |

| Investment Opportunities | Knowledge of market trends opens doors to wealth creation. |

| Budgeting Skills | Effective budgeting cultivates a stable financial landscape. |

Key Concepts in Finance Education That Everyone Should Know

Finance education opens a world where investment strategies twist and turn like a dance, creating opportunities for financial growth. Understanding the difference between assets and liabilities helps clarify effective budgeting. Moreover, grasping the concept of interest becomes vital, especially when navigating personal loans. Financial literacy isn’t just about numbers; it’s about shaping decisions that impact your future significantly. As you delve deeper, remember that every term holds a story waiting to be uncovered, making finance an intriguing journey.

Bridging the Gap: Enhancing Financial Skills Across Diverse Populations

Empowering individuals with financial acumen is vital, especially in our diverse world. Tailoring educational resources to fit various backgrounds can close the knowledge gap. This effort requires innovative approaches, fostering inclusivity and accessibility. By encouraging financial literacy, we cultivate a culture of informed decision-making. Here are some strategies:

- Community Workshops: Educational sessions held in local venues foster engagement and understanding of key financial concepts.

- Online Resources: Creating user-friendly websites and apps enhances finance knowledge for all demographics.

- Culturally Relevant Materials: Adapting content to reflect the community’s values makes learning about finance relatable and engaging.

Ultimately, bridging this gap benefits not only individuals but society as a whole. Because when people thrive financially, communities flourish, creating a ripple effect of empowerment. Together, let’s pave the way for a brighter, financially literate future!

Real-World Benefits of Investing in Finance Education for Personal Growth

Investing in finance education opens doors to countless opportunities, transforming not only your understanding of money but also your approach to life. Many overlook how mastering finance concepts can strengthen personal relationships and boost self-confidence. Moreover, improving your financial literacy empowers you to make smarter choices. You learn to navigate the complex world of investments and savings, understanding that clarity in finance directly impacts your overall well-being. This investment in yourself cultivates resilience and adaptability, enriching both your personal and professional life.

You Can Also Review These:

Unlocking Financial Wisdom: Your Essential Guide to Self …

Conclusion

In conclusion, finance education plays a crucial role in shaping our understanding of personal and collective financial wellbeing. Many individuals overlook its importance, yet it can significantly impact their decision-making processes. By prioritizing financial literacy, we empower ourselves to navigate the complexities of budgeting, saving, and investing. This foundation helps us build a secure future, leading to reduced stress and increased confidence in our financial choices. Ultimately, enhancing our finance education is a vital step toward achieving greater stability and prosperity in our lives.

Frequently Asked Questions

What is financial education?

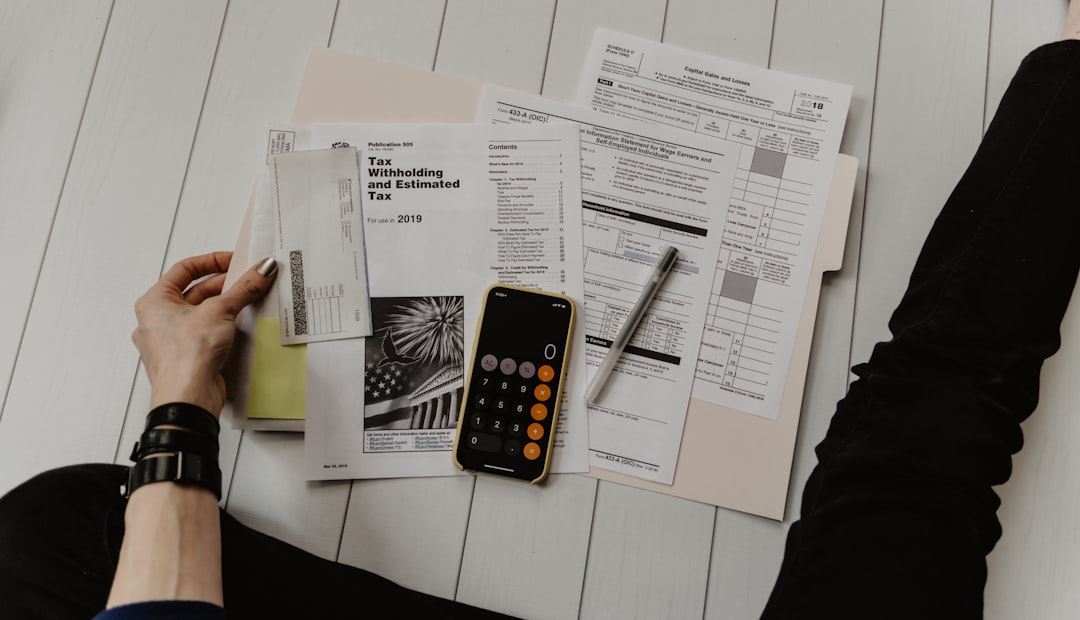

Financial education is the process of acquiring knowledge and skills related to managing personal finances, including budgeting, saving, investing, and understanding financial products.

Why is financial education important?

Financial education is important because it equips individuals with the skills to make informed financial decisions, avoid debt, plan for retirement, and ultimately achieve financial stability and independence.

How can I improve my financial education?

You can improve your financial education by reading books, attending workshops, taking online courses, and following credible financial blogs or podcasts.

At what age should I start financial education?

It’s beneficial to start financial education as early as possible, ideally during adolescence, to build good financial habits and understand the value of money before entering adulthood.

Are there any free resources for financial education?

Yes, there are many free resources available, including online courses, podcasts, articles, and community workshops offered by financial organizations or non-profits.