In the fast-paced world of finance, the path to building wealth often feels like a maze. Everyone is looking for that golden key, a surefire way to enhance their financial health. Yet, the secrets to prosperity may lie in unexpected places. As we delve into some surprising yet effective *finance tips*, you’ll discover insights that could shift your perspective and motivate you to take action. After all, wealth isn’t just about earning; it’s about smart choices and wise decisions that can pave the way to financial freedom.

Main Points

- Understanding the power of small, consistent savings.

- Utilizing automated tools for better budgeting.

- Learning the benefits of investing in education.

- Exploring alternative income streams.

- Building a supportive financial network.

- Embracing minimalism for financial clarity.

- Recognizing the impact of lifestyle choices.

- Considering the value of negotiation skills.

- Being aware of the psychological aspects of money.

- Investing in health for long-term financial benefits.

Related content:

Unlocking Creativity: 10 Fun Activities to Spark Your Kid’s Imagination

1. Rethinking Your Budget: Innovative Strategies for Financial Freedom

In an age where conventional wisdom about finance falters, it’s time to embrace a fresh perspective on budgeting. Finding freedom in your finances doesn’t merely mean cutting costs; it’s about reimagining your priorities. Start by questioning everything. Why do we spend on subscriptions we rarely use? How can we swap extravagant dinners for delightful home-cooked meals? Tap into your creativity and consider alternative income sources. Here are some innovative strategies:

- Automate Savings: Set up transfers to savings automatically; let technology work for you.

- Mindful Spending: Reflect on purchases to ensure they align with your values and goals.

- Share Experiences: Opt for shared activities over costly outings; create memories, not bills.

Ultimately, the journey to financial freedom is built on conscious choices. Embrace the unusual, rethink norms, and watch your financial landscape transform.

2. The Power of Compound Interest: How Small Investments Can Lead to Big Gains

Imagine planting a tiny seed that grows into a magnificent tree. This is akin to finance through compound interest. With each small investment you make, your money doesn’t just sit; it grows, and the interest earned begins to earn its own interest. It’s a fascinating cycle, really. You might find yourself wondering how your little savings can translate to remarkable wealth. Embrace patience; achieving financial freedom often starts with the smallest of beginnings.

Why It Works

Because of the principle of time and the magic of compounding, your initial investment can snowball. If you neglect to start early, however, the potential can slip away like grains of sand.

| Years | Investment | Total Value |

|---|---|---|

| 5 | $1,000 | $1,628.89 |

| 10 | $1,000 | $2,593.74 |

By understanding the power of compound interest, you’re not just playing the finance game; you’re changing its rules, making it work for you. So, get started today! Your future self will thank you, and who knows, your small beginnings may blossom into something truly extraordinary.

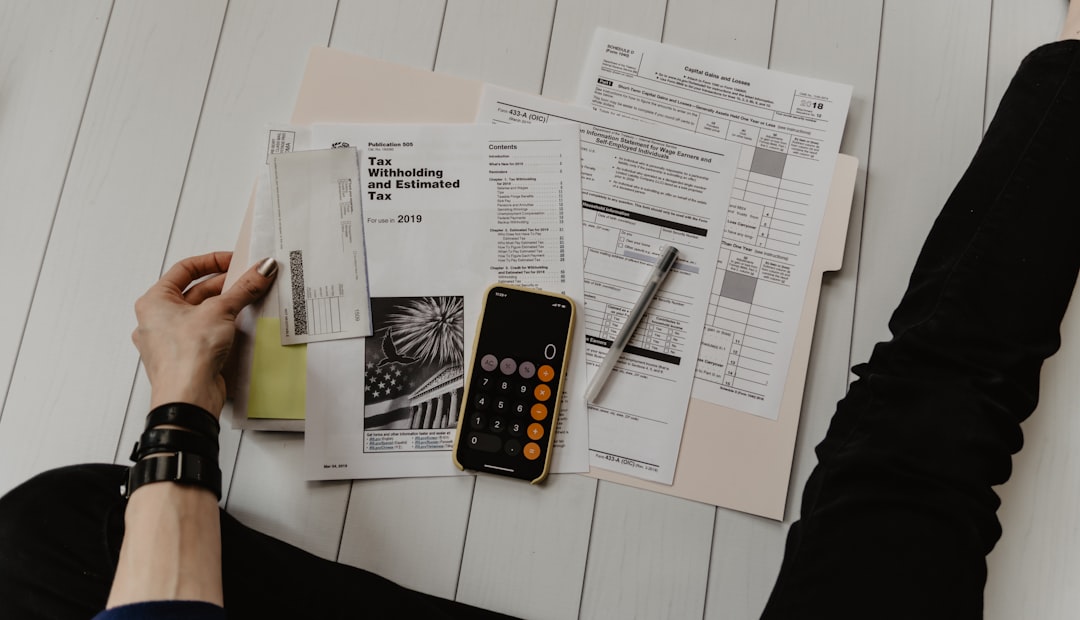

3. Hidden Costs: Identify and Eliminate Unseen Expenses Draining Your Wealth

Your financial landscape can often hide secrets beneath its surface. Unseen expenses, like sneaky subscription fees or excessive interest payments, silently siphon away your wealth. Start by scrutinizing your bank statements. You might discover a forgotten streaming service or an outdated gym membership. By identifying these finance drains, you can take steps to eliminate them. This proactive approach not only bolsters your budget but also empowers you to redirect that money towards more fulfilling pursuits.

4. The Importance of Building an Emergency Fund: A Safety Net for Your Finances

Establishing an emergency fund is like crafting a safety net beneath your financial tightrope. Imagine unexpected expenses crashing down, be it medical bills or car repairs. Having a cushion ensures you’re not scrambling when life throws a curveball. Furthermore, this fund fosters peace of mind, allowing you to focus on long-term goals rather than day-to-day anxieties. After all, it’s not about the amount saved but the commitment to secure your financial future. Every dollar counts!

- Define Your Goal: Determine how much you should save to cover 3 to 6 months’ worth of expenses.

- Choose a Savings Account: Select a high-yield savings account for better returns.

- Automate Your Savings: Set up automatic transfers to bolster your fund consistently.

By focusing on these steps, you create a solid foundation for your finance journey, ensuring you’re prepared for whatever comes your way. Remember, it’s about resilience and readiness in the world of finance.

5. Alternative Income Streams: Exploring Passive Income to Boost Your Wealth

In today’s ever-evolving financial landscape, passive income has become a beacon for many seeking to enhance their wealth. Imagine generating revenue while you sleep! This intriguing concept often leads to brainstorming various opportunities, like rental properties or dividend stocks. The beauty of passive income lies in its potential; however, one must navigate the intricacies with care. Do you prefer the reliability of a finance strategy or the thrill of an entrepreneurial venture? Each path can lead to surprising outcomes, but knowing your goals is vital.

Navigating the Waters of Passive Income

To truly unlock success, diverse options exist, whether through online courses, affiliate marketing, or even creative endeavors. But, beware! The journey requires patience and a keen understanding of the finance world. Are you ready to embrace the challenge and explore the vast ocean of opportunities? Remember, the more informed you are, the smoother your voyage toward building wealth will be. So, which income stream resonates with your aspirations? The choices are as diverse as the finance tools available. Dive in and discover what works best for you!

Credit Cards Demystified: Using Rewards and Points to Your Financial Advantage

Unlocking the potential of credit cards can feel like navigating a labyrinth. Many find themselves lost in the maze of rewards and points. However, with a bit of strategy, you can transform these *financial* tools into allies. Choosing the right card is essential. Not all cards offer the same perks. Some provide travel points, while others focus on cash-back options.

“Understanding the nuances of your choices can reshape your *financial* future.”

To truly benefit, track your spending patterns. Align them with the rewards offered. This way, you maximize your benefits. Yet, beware of overspending just for points. Moderation is key in this *financial* dance.

| Credit Card Type | Rewards Structure | Ideal User |

|---|---|---|

| Travel Rewards | Miles for travel | Frequent travelers |

| Cashback | Cash back on purchases | Everyday spenders |

Take charge of your *financial* journey. Those who master the art can reap delightful rewards!

7. Investing in Yourself: How Education and Skills Can Propel Your Financial Growth

Investing in yourself is a powerful strategy for enhancing your financial potential. By focusing on education and skills, you not only open doors to new opportunities but also increase your market value. This journey, however, is not always straightforward. It requires dedication and insight. Here are some key areas to consider:

- Continuous Learning: Embrace lifelong education through courses, workshops, and online resources. The more you know, the further you grow.

- Networking: Build relationships with professionals in your field. Connections can lead to unexpected opportunities and collaborations.

- Skill Development: Focus on enhancing specific skills that are in demand. This could mean mastering a software or improving your public speaking abilities.

Ultimately, your commitment to self-improvement will reflect in your financial journey. Strive for growth, and watch your prospects flourish.

You Can Also Review These:

Unlock Your Financial Future: 10 Essential Tips For Personal Finance

Conclusion

In summary, we explored the intricacies of managing your finances wisely. Understanding the importance of budgeting, saving, and investing can profoundly impact your financial well-being. Good practices often lead to better financial stability and confidence. Sharing finance tips can empower others to take control of their economic futures. This shared knowledge can cultivate a community where everyone works toward financial literacy together. Ultimately, taking small steps today can build a brighter future for tomorrow.

Frequently Asked Questions

What is the best way to create a personal budget?

The best way to create a personal budget is to track your income and expenses, categorize them, and set limits for each category. Use budgeting apps or spreadsheets to help you stay organized and on track.

How can I start saving for retirement?

Start saving for retirement by contributing to an employer-sponsored retirement plan, such as a 401(k), especially if they offer a matching contribution. Additionally, consider opening an Individual Retirement Account (IRA) to maximize your savings.

What are some ways to pay off debt more quickly?

To pay off debt more quickly, consider using the snowball method by paying off the smallest debts first to gain momentum, or the avalanche method by focusing on debts with the highest interest rates. Additionally, look for ways to increase your income or reduce expenses to allocate more towards debt repayment.

How can I improve my credit score?

You can improve your credit score by paying bills on time, reducing credit card balances, avoiding new hard inquiries, and regularly checking your credit report for errors that you can dispute.

What should I consider when investing in stocks?

When investing in stocks, consider your risk tolerance, investment goals, and the time horizon for your investments. Additionally, research the companies you are investing in and diversify your portfolio to spread out risk.